take home pay calculator manitoba

This marginal tax rate means that your immediate additional income will be taxed at this rate. Youll then get your estimated take home pay a detailed breakdown of your potential tax liability and a quick summary down here so you can have a better idea of what to expect when planning your budget.

Manitoba Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Use the simple annual Canada tax calculator or switch to the advanced Canada annual tax calculator to review NIS payments and income tax deductions for 2022.

. Usage of the Payroll Calculator. Take for example a minimum wage worker in 2016 or 2017 that works 368 hours per week 4 weeks and 5 vacations holidays for a total of 5 holiday weeks. Personal Income Tax Calculator - 2021 Select Province.

Calculate your take home pay in 2022 thats your 2022 salary after tax with the Canada Salary Calculator. This marginal tax rate means that your immediate additional income will be taxed at this rate. Your average tax rate is 314 and your marginal tax rate is 384.

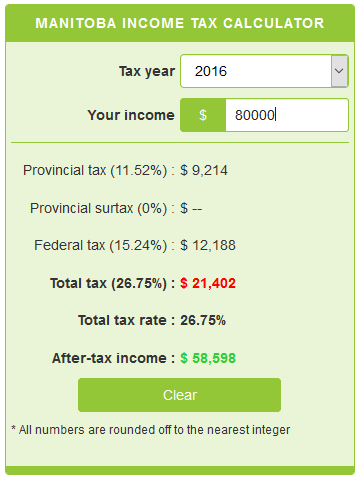

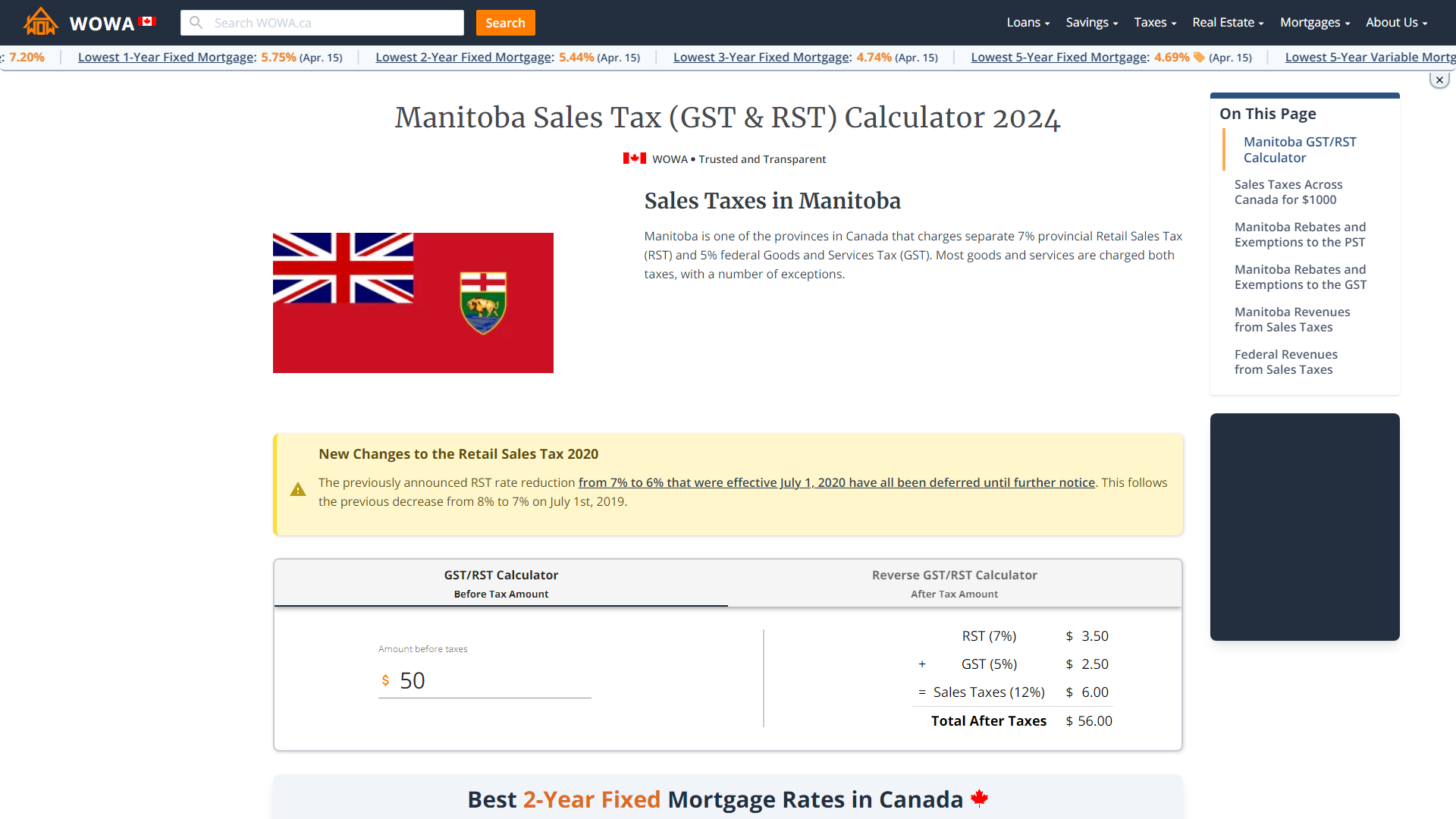

Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax Tables. Newfoundland Prince Edward Island Nova Scotia New Brunswick Quebec Ontario Manitoba Saskatchewan Alberta British Columbia Northwest Territories Nunavut Yukon.

Welcome to the Severance Pay Calculator. Your average tax rate is 220 and your marginal tax rate is 353. The formula for calculating your annual salary is simple.

Your average tax rate is 220 and your marginal tax rate is 353. You can use the calculator to compare your salaries between 2017 and 2022. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services.

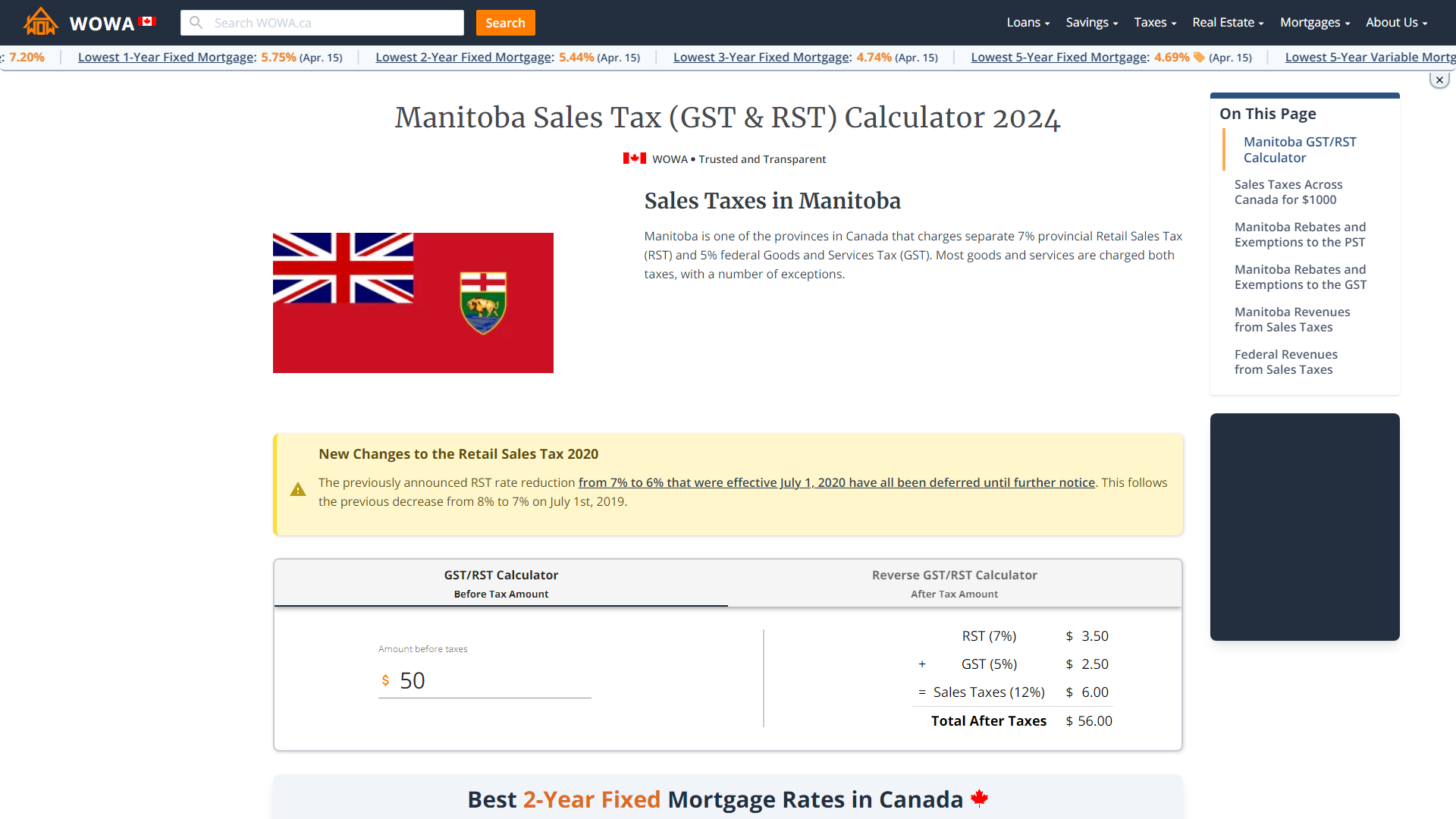

Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related tax allowances. Tax brackets in the Manitoba province decide your tax rate. 368 hours per week x 52 weeks per year - 5 Holiday Statutory weeks 172960 hours of work per year.

If you earn more than 72885 youll pay a 174 tax rate on that income. The Canada Tax Calculator is a diverse tool and we. The marginal tax rate for first 30000 is 0 on the next 60000 is 05 on the next 60000 is 1 and so on.

Determine taxable income by deducting any pre-tax contributions to benefits. The calculator is updated with the tax rates of all Canadian provinces and territories. A take home pay calculator Manitoba can help you calculate your take-home income.

The amount can be hourly daily weekly monthly or even annual earnings. Remember that how much tax you will pay on your salary in Manitoba is a function of federal and provincial taxes rates and. In this example you could access 105000 through a HELOC as it only amounts to 30 of your.

To start complete the easy-to-follow form below. Take Home Pay Calculator by Walter Harder Associates. That means that your net pay will be 35668 per year or 2972 per month.

Although our salary paycheck calculator does much of the heavy lifting it may be helpful to take a closer look at a few of the calculations that are essential to payroll. British Columbia Alberta Saskatchewan Manitoba Ontario New Brunswick Nova Scotia Prince Edward Island Newfoundland Yukon Northwest Territories Nunavut. Enter your pay rate.

Enter your salary into the calculator above to find out how taxes in Manitoba Canada affect your income. If you make 52000 a year living in the region of Manitoba Canada you will be taxed 16332. In Canada income tax is usually deducted from the gross monthly salary at source through a pay-as-you-earn PAYE system.

Annual salary average hours per week hourly rate 52 weeks minus weeks of vacation - weeks of holidays For example imagine someone earns 15 per hour in Manitoba works an average of 35 hours per week and has a total of 4 weeks of vacation and holidays. Single SpouseEligible dep Spouse 1 Child Spouse 2 Children Spouse 3 Children. Income Tax Calculator Manitoba 2021.

You can easily estimate your net salary or take-home pay using HelloSafes calculator above. If your taxable income is below 33723 youll pay taxes at a 108 tax rate. Select Province and enter your Annual salary.

You assume the risks associated with using this calculator. When you sell a house in Manitoba you pay the land transfer tax on marginal tax rates. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Were bringing innovation and simplicity back into the Canadian payroll market from new ways to pay your employees to our open developer program. Multiply Hours 172960 by the minimum wage in 2015-2016 11 hour 19 02560 in.

This calculator is intended for use by US. Just enter your annual pre-tax salary. This tool will calculate both your take-home pay and income taxes paid per year month two-week pay period and day.

The Manitoba Income Tax Salary Calculator is updated 202223 tax year. A quick and efficient way to compare salaries in Canada in 2022 review income tax deductions for income in Canada and estimate your 2022 tax returns for your Salary in Canada. Avanti Gross Salary Calculator When you take out a mortgage to buy a home you know how much your monthly mortgage payment will be.

This places Canada on the 12th place in the International Labour Organisation statistics for 2012 after France but before Germany. How to calculate net income. That means that your net pay will be 40568 per year or 3381 per month.

About the 2022 Manitoba Salary Calculator. Were making it easier for you to process your payroll and give your employees a great experience with their payslips. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for each market sector and location.

A take home pay calculator Manitoba can help you calculate your take-home income. Please indicate which one of the following roles applies to you. Toronto - Vancouver - Ottawa - Calgary - Edmonton - Hamilton - Brampton - Oakville - Mississauga - Richmond Hill - North York - Scarborough - Barrie - Kanata -.

Salary paycheck calculator guide. Newfoundland Prince Edward Island Nova Scotia New Brunswick Quebec Ontario Manitoba Saskatchewan Alberta British Columbia Northwest Territories Nunavut Yukon. The average monthly net salary in Canada is around 2 997 CAD with a minimum income of 1 012 CAD per month.

It will confirm the deductions you include on your official statement of earnings. Personal Income Tax Calculator - 2020 Select Province. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Now you still need to make sure that 105000 doesnt exceed 65 of your homes value. Enter your pay rate. The ability to pay off student loans more.

Use this simple powerful tool whether your employees are paid salary or hourly and for every province or territory in Canada. How much tax do you pay when you sell a house in Manitoba. A take home pay calculator Manitoba can help you calculate your take-home income.

It can also be used to help fill steps 3 and 4 of a W-4 form.

How Do You Calculate Take Home Pay Ontario Cubetoronto Com

Manitoba Income Tax Calculator Calculatorscanada Ca

Why Do People Say That Half Your Salary Goes To Taxes In Canada Say Your Income Is 100k Should You Expect To Take Home 4k Per Month After Taxes Quora

2021 2022 Income Tax Calculator Canada Wowa Ca

Manitoba Gst Calculator Gstcalculator Ca

Manitoba Income Tax Calculator Wowa Ca

Manitoba Sales Tax Gst Rst Calculator 2022 Wowa Ca

Avanti Gross Salary Calculator

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

![]()

Manitoba Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Manitoba Salary After Tax Calculator World Salaries

Manitoba Property Tax Rates Calculator Wowa Ca

2022 Manitoba Tax Calculator Ca Icalculator

Manitoba Student Aid Awards The University Of Winnipeg

This Is The Ideal Salary You Need To Take Home 100k In Your State